- Home ›

- One Stop Europe ›

- Ecommerce Business Plan

An Ecommerce Business Plan For Europe

Seamless cross-border ecommerce is key to future European growth & prosperity. But if designed by the national incumbents, national barriers will remain.

At A Glance

- Digital giants such as Amazon and Google are developing ecommerce delivery solutions focused on the needs of the recipient.

- Following their example, thousands of European ecommerce vendors have understood that they must actively create their own, alternative, seamless cross-border delivery systems to secure their future business.

- However, ecommerce business plans drawn up by national postal incumbents are designed to protect market dominant structures, rather than opening up a level playing field.

Despite the best intentions of the Universal Postal Union (UPU), national postal incumbents in Europe are making every effort to retain their domestic monopolies.

Their ecommerce business plan strives to extend their dominance from the physical into the digital sphere.

However, other stakeholders are rapidly identifying the vast potential of a changing, data-driven, ecommerce market environment, and are keen to play a role in shaping its future and reaping its benefits.

Ecommerce growth needs seamless markets...

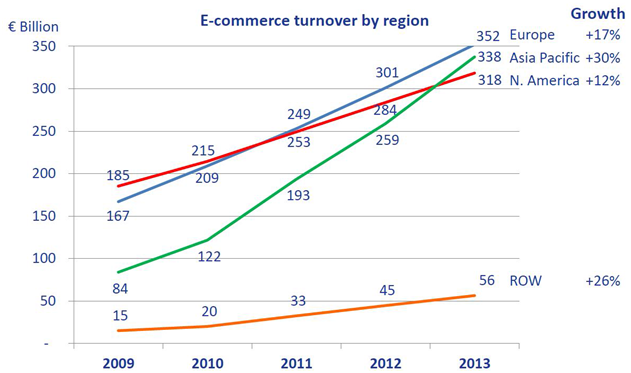

If we look at global ecommerce business indicators, Europe still just leads the global market in ecommerce. However, this will change as emerging economies gain ground, especially if Europe falters in creating the necessary framework for a single market based on seamless cross-border ecommerce.

Fig.1: Source EMOTA 2013 (Note: B2C ecommerce turnover includes online travel, digital downloads and event tickets, but excludes online gaming and financial services)

European legislators have identified cross-border ecommerce as one of the potential drivers for growth and prosperity in Europe.

However, postal services still dominate their domestic markets for last mile delivery in Europe.Their economic strength and political influence is enormous, and to date they have sheltered their domestic markets by maintaining barriers to ecommerce integration.

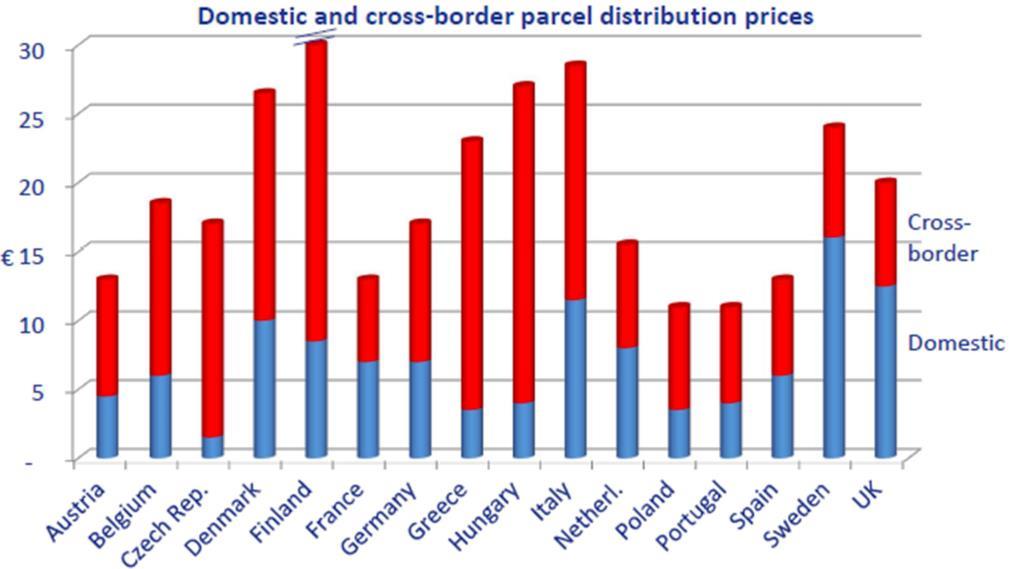

Not only are domestic rates significantly lower than cross-border rates (in most European countries ½ that of cross-border rates), but other hurdles include:

- National label designs

- Compulsory bar codes

- Missing cross-border track & trace solutions interfaces

- Label sizes

- Compulsory postal logos

- Parcel dimensions

- Restricted access to parcel lockers and drop off locations

These all serve to enforce incumbents’ monopolies in their domestic markets, and are a major reason why only 25% of European ecommerce providers offer cross-border delivery within the EU.

Fig. 2: Source FTI, 2011; Domestic and weighted average cross-border prices for 1 kg parcels

...but chances are being missed to create a level playing field

At the end of 2013 the European Commission issued a green book analysing the current status of ecommerce in Europe and outlining the conditions needed to create a level playing field.

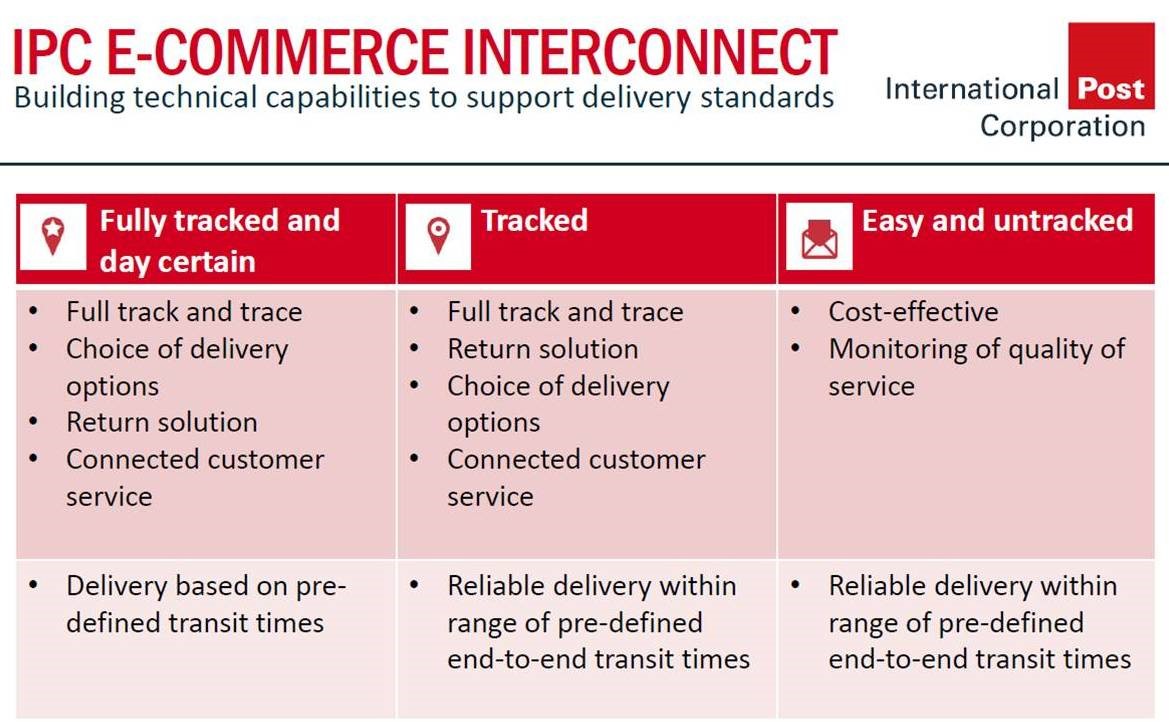

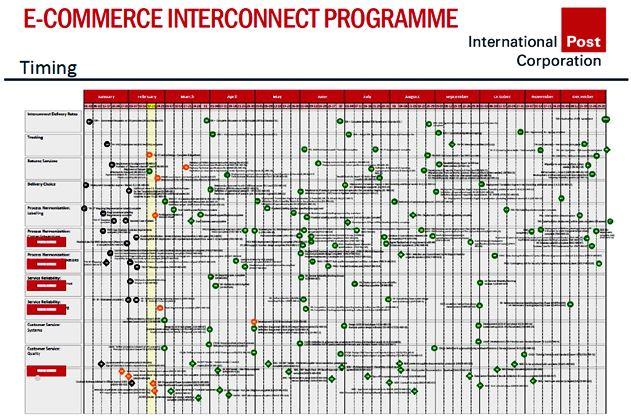

Threatening political, regulative or even legislative interference if Europe’s postal players failed to come up with an ecommerce business plan ensuring a unified market for ecommerce within 18 months, the reaction of the incumbents has been straightforward and predictable: through their own European organisations – the International Post Corporation (IPC) and PostEurope – they are lobbying and pushing a European solution for cross-border ecommerce which is designed chiefly to benefit their own members.

By creating their own standards and specifications, their solution creates hurdles for outsiders.

Fig. 3: IPC’s e-CIP: A vast and extremely complex project involving all European postal services and allegedly costing over EUR 20 million per annum. An ecommerce business plan to secure the continued dominance of national incumbents in Europe.

But we can’t just point the finger at the IPC.

The European Commission has also largely failed to push its free market agenda: no mandates have been issued to European standardisation authorities to help to create supporting infrastructure for third party stakeholders, customers, consumers and potential competitors.

However, in their annual Union work program for European standardization for 2015, the European Commission has recognized that standardization of specific features of parcel delivery services, and the revision of existing European standards on postal services, is necessary.

Therefore in late 2014 CEN TC331 adopted two new proposed Work Items:

- On the Measurement Transit Time Parcels Using Track And Trace.

'The standard will focus on the methods for measuring the transit time for cross-border parcels, mainly from emerchants and with an attention for the smallest and medium-sized companies'. As previously studied, the method uses the events of the track and trace process.

- On Interfaces For Cross-Border Parcels.

'The standard will specify the interface between the emerchant (any professional customer sending parcels) and the first logistic operator. The interface is composed of two items, 1. the physical label, stuck on the parcel: contents, sizes, minimum requirements to guarantee the quality and efficiency of the logistic process (sorting, delivery). 2. the electronic exchanges between the sender and the logistics operator with the description of the data to be provided, the format of the exchanges.'

CEN TC331 postal services adopted both new work item proposals under

the premise that both track and trace and the interfaces will lead to open technical standards

which are available to ALL operators. That means, any closed standards

only applicable to designated operators must be supplemented by

equivalent, open standards (i.e. GS1's supply chain management

non-profit standards) available to all online merchants and courier,

express and postal services.

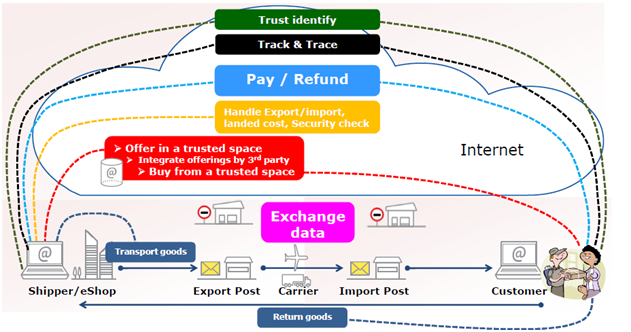

Little consideration has been given to an obvious means of incorporating existing expertise: the UPU’s Postal Technology Center has already developed state-of-the-art ICT-based technology to facilitate cross-border ecommerce platforms.

These use UPU standards to ensure interoperability with global customs and payment channels, seamless Track & Trace, and cross-border clearing, based on quality of service parameters. The UPU also offers customer service links, return shipment and accountability measures, all required by air carriers and other third parties at the interfaces with the UPU global postal network.

Fig. 4: The UPU’s ecommerce platform – global standards already available for all. The technology is in place and ready to serve the global network governed by 193 states worldwide.

In short, ecommerce developments in Europe are ignoring and running parallel to the UPU’s work in establishing state of the art ICT solutions for all. The member states of the UPU have already established a new intergovernmental, global, highly secure digital platform for global, seamless, cross-border ecommerce - .post. It just needs to be used.

Ecommerce changes the postal product mix

The need to further integrate ecommerce with products and services better attuned to customer demands leads to new product specifications.

Ecommerce changes the postal carrier product mix, turning them from document-driven to commercial goods-driven delivery companies: note Deutsche Post’s recent move in changing the name of their Mail Division to Post-eCommerce – Parcel [PeP] Division.

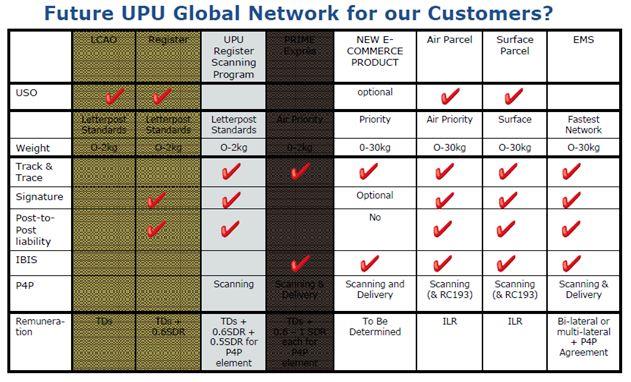

Thus the work of the UPU, a dedicated organisation of the UN, in fostering global product and services specifications to serve the global delivery network has been well received.

Fig. 5: The UPU has recognised the need for a dedicated global product and service portfolio for 0 – 30 kg ecommerce items.

But the individual interests of the incumbents paired with the lack of action at EU level to foster sustainable economic growth by enabling and encouraging competition, is resulting in new developments: not being invited to join in, third party competitors are looking to alternatives.

No room for monopolies in ecommerce business

Communication logistics are changing business models by extending the forward integration of business processes into the core of any customer interaction. Postal services are following this trend.

However, in a digital world ecommerce providers already undertake their own customer and data management activities - all they need from a postal service is the actual delivery!

So it is here that their interests conflict directly with those of the postal incumbents who are actively striving to maintain their hold along the entire logistics value chain. As ecommerce is driving the growth in registered commercial letter mail items up to 2kg, postal services will need to offer relevant services - including same day and time-certain delivery - if they wish to thrive in this sector.

As a result, the segmentation of the market and the sheer volume of business is starting to awaken interest amongst investors from outside the classic post and logistics industries.

Fig. 6: Germany’s logistics start-up landscape

The faster business becomes data-driven, and thus dependent on communication logistics, the more that start-ups will move into this highly diversified and rapidly changing market.

With over 30,000 ecommerce vendors in Germany alone, the lack of an established open playing field inevitably encourages the development of an alternative, open systems approach.

The first such moves in Germany are being made by the Open Postal Alliance whose aim is to provide access to all elements of the overall value chain. One such element could be access to the UPU’s global delivery network which offers set import and export prices to all those who qualify.

Ecommerce is global and digital. Recent European developments which provide the legal & regulatory framework for a highly connected digital society – e-Identities, secured e-delivery, e-seals and trust services – are encouraging the emergence of state-of-the-art reference models which integrate all the necessary elements of added value (identity, delivery options, customs, payment, returns, insurance, track & trace, e-invoicing, e-forms).

Most business processes are becoming highly integrated and cross-border ecommerce will follow this trend. The better trade functions across borders – including a very diversified but highly traceable delivery element – the more sustainable the current economic recovery will be.

Platforms which integrate customs declaration systems, payment solutions, electronic identification of attributes and credential of senders, recipients and vital contributors in the value related service offering, will win the first development cycle.

Subsequently, whoever is able to prove that the underlying reference model is up to the task of supporting highly fragmented value chains, offering close to real time, end-2-end transparency, will survive the growth cycle to achieve a sustainable business model and create value.

Walter Trezek is the Chairman of the Consultative Committee (CC) of the Universal Postal Union (UPU).

- Home ›

- One Stop Europe ›

- Ecommerce Business Plan

Does this article cover a topic relevant to your business? Access the CLS Business Lounge for the market intelligence you need to stay ahead of the crowd. Find out more