- Home ›

- One Stop Europe ›

- VAT in the Digital Age (ViDA)

VAT in the Digital Age (ViDA)

The upcoming reform of the EU's VAT legislation – ViDA – heralds the next digital disruption in ecommerce

At A Glance

- ViDA and real-time digital reporting of all transactions (e-Invoicing)

- ViDA and OSS 2.0: single VAT registration (ID) across the EU

- ViDA and IOSS 2.0: IOSS become mandatory for all B2C supplies imported to the EU

- The impact of these changes on marketplaces

- Marketplace liability & transparency - linking VAT ID & transport ID

On 8 December 2022, the EU Commission adopted a package to optimise the EU’s Value Added Tax (VAT) system called ViDA, or "VAT in the Digital Age".

As a Council Regulation, ViDA will be binding for all Member States. The EU Commission is currently working on the assumption that a consensus can be reached. The negotiations with the Member States, which will then lead to a decision, will be conducted under the Swedish EU Presidency beginning January 2023.

In the parts relevant to ecommerce, ViDA builds on the EU VAT Ecommerce Package introduced in 2021. This article outlines the content of the reform, before exploring the background to ViDA and its future impact.

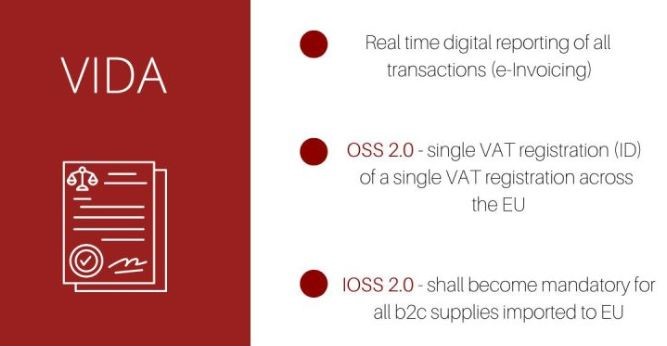

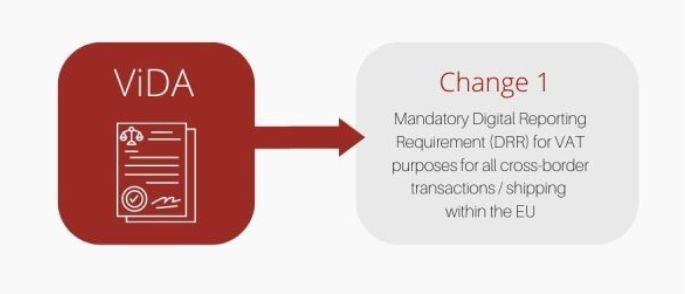

ViDA brings 3 major changes for ecommerce:

ViDA is expected to generate at least EUR 11 billion per year in additional VAT revenue (avoided VAT fraud), and billions of euros in savings through administrative simplification.

These 3 changes are explored in more detail below.

1. ViDA and real-time digital reporting of all transactions (e-Invoicing)

According to the EU VAT GAP report which estimates the overall difference between expected VAT revenue and the sums actually collected, EU Member States lost an estimated €93 billion in Value Added Tax (VAT) revenue in 2020, mainly due to tax fraud and evasion.

The EU’s action plan focuses on fully digitalising all transactions, making every transaction transparent and traceable so that taxes can be collected correctly, and items checked for compliance.

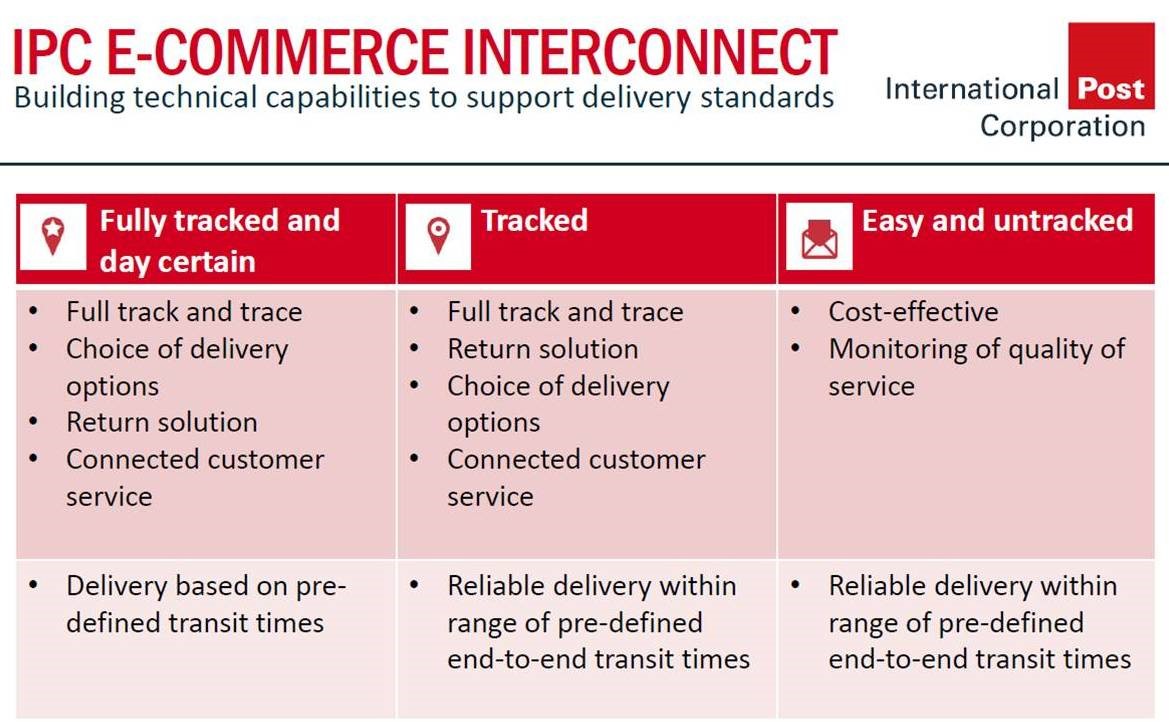

With respect to ecommerce, the EU VAT Ecommerce package has made Electronic Advanced Data (EAD) mandatory for all consignments imported into the EU for clearing at item level (customs).

To date, there has been no comparable transaction-based digital traceability for cross-border ecommerce shipments within the EU. The standard has been monthly/quarterly recapitulative statements, making VAT fraud comparatively easy. The EU Commission intends to close this gap.

The new transaction-based model – the Digital Reporting Requirement (DDR) – is scheduled to enter into force in 2028

Outline:

- The Standardised European e-Invoicing Norm (EN) with its structured electronic format which will become the mandatory default system for issuing invoices (including ecommerce)

- Development of a EU database for the exchange of information on intra-community VAT transactions (based on VIES - the central VAT Information Exchange System)

- The subset of data elements mandatory for e-Invoicing must be submitted to the local tax authority by the supplier and acquirer (day of transaction)

- The local tax authority sends the data to central VIES within 24 hours

- VIES crosschecks transactions, reported supplies and acquisitions, to ensure compliance and detect fraud

- The data format is based on a European Norm and is interoperable

- Domestic DRR will become optional for Member States and will follow the DRR model

2. ViDA and OSS 2.0: Single VAT registration (ID) across the EU

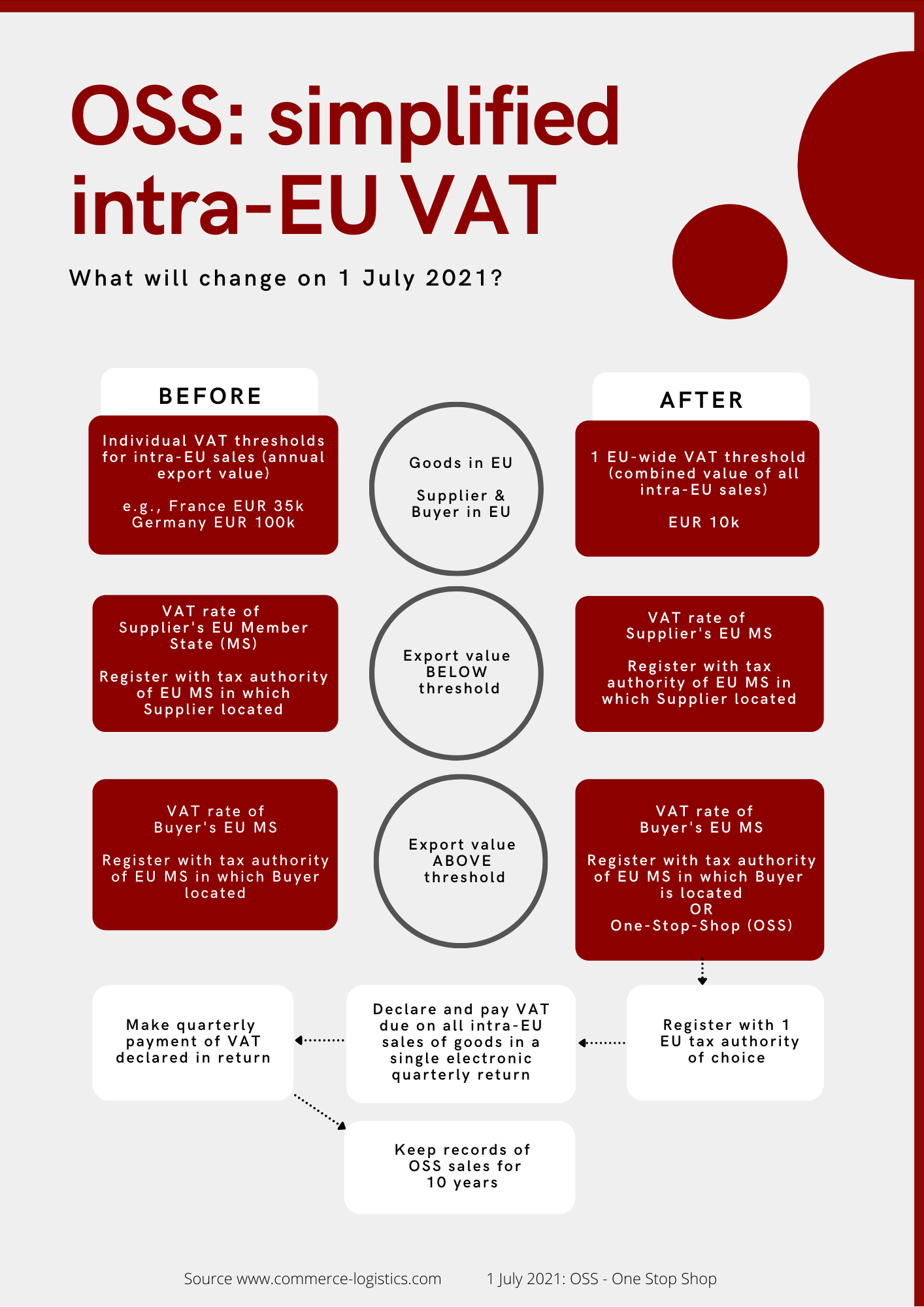

While the EU VAT Ecommerce Package introduced a single IOSS VAT Identification number for the import of low value consignments (IOSS) into the EU, reform of the Intra-EU One-Stop-Shop (OSS) did not go that far.

The OSS initially remained a compromise, one which did not reach the degree of harmonisation achieved by IOSS. The OSS mechanism has allowed businesses to pay VAT incurred on certain types of B2C transactions by using a single VAT registration. Nonetheless, numerous circumstances have remained that oblige businesses to obtain and hold more than one VAT registration in the EU.

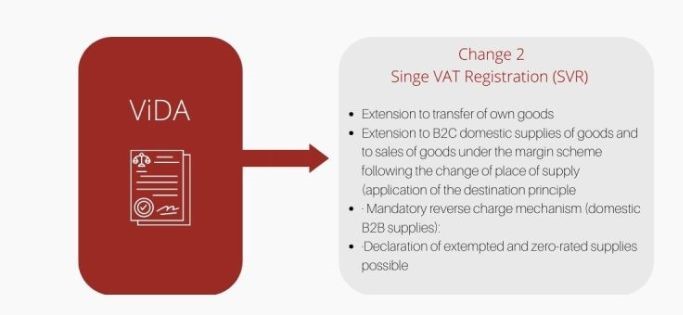

The new regulation improves and expands the existing OSS system by introducing a true Single VAT Registration (SVR) for the intra-EU distance sales of goods. The changes include:

- Extension to transfer of own goods: SVR is applicable when a deemed supplier transfers goods from stock in one EU Member State to stock in another EU Member State in order to facilitate B2B supplies of goods within the EU.

- Extension to B2C domestic supplies of goods, and to sales of goods under the margin scheme following the change of place of supply (application of the destination principle).

- Mandatory reverse charge mechanism (domestic B2B supplies): Member States must allow for the reverse charge mechanism in situations where a supplier is not established in the Member State in which VAT is due.

- Declaration of exemption and zero-rated supplies possible.

By its very nature, the new single VAT ID will be linked with the mandatory Digital Reporting Requirement (DRR) for VAT purposes for all cross-border transactions within the EU. It is based on mandatory e-Invoicing, allowing every transaction to be clearly linked to a VAT registration. This ensures a high degree of transparency and makes VAT fraud much more difficult.

3. ViDA and IOSS 2.0: IOSS becomes mandatory for all B2C supplies imported to the EU

On 1 July 2021 the low value consignment (LVC) import VAT exemption for commercial goods (EUR 22 threshold) was abolished. Since then, all distance sales of imported goods have been subject to VAT in the Member State (MS) of consumption, calculated from the first cent.

To simplify compliance and enforcement, the Import One-Stop-Shop (IOSS) was introduced (optional). It allows suppliers

- importing goods into the EU

- which are not subject to excise duties

- to charge the customer VAT at point-of-sale (checkout),

- declare VAT using IOSS via an EU-based fiscal representative,

- and pay all VAT to multiple EU destination countries using a tax authority in a selected MS.

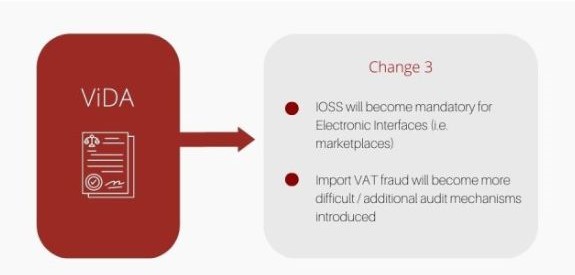

IOSS now becomes mandatory for all Electronic Interfaces (i.e., marketplaces)

The ViDA regulation makes the use of the IOSS mandatory

- for distance sales to the EU from third countries;

- for consignments of an intrinsic value not exceeding EUR 150; and

- where an Electronic Interface facilitates the sale (i.e., platforms, marketplaces acting as deemed suppliers).

This covers over ¾ of all cross-border transactions into the EU. All marketplaces will have to register for IOSS in an EU MS and use this scheme for all B2C imports to EU:

“Member States shall require the taxable person acting as deemed supplier in accordance with Article 14a(1) to use this special scheme for all its distance sales of goods imported from third territories or third countries.”

Import fraud will become more difficult / additional audit mechanisms

The new regulation provides customs authorities with access to IOSS registration data, including the list of underlying suppliers added to the records provided by platforms. This data not only allows the validity of an IOSS ID to be checked, but also whether the supplier is legally entitled to use the IOSS ID of a third service provider or marketplace.

The impact of these changes on marketplaces

Marketplaces play a decisive role in ecommerce. Their platforms handle the sales of millions of online retailers and provide additional services along the supply chain, from warehousing, fulfilment, and delivery to digital value-added services. More than three-quarters of global ecommerce is facilitated by marketplaces.

The actual (legal) role of marketplaces is a matter of debate. Marketplaces traditionally claim to be mediators, noting that contracts are directly concluded between the online merchants using their platforms and consumers. The reason marketplaces favour this interpretation, of course, is to avoid as much liability as possible.

The EU takes a different view, and this is reflected in the new ViDA package.

Further extension of scope of marketplace VAT liability

VAT liability is based on the EU “deemed supplier model”.

- The decisive factor is from whom the consumer assumes they are making a purchase.

- The marketplace is ‘deemed’ to be purchasing the goods from the underlying supplier.

- The marketplace is then subsequently ‘deemed’ to be selling those goods to the consumer.

- Consequently, the marketplace is legally liable for reporting and paying the VAT on the ‘deemed supply’.

The significant change which came into force on 1 July 2021 (EU VAT Ecommerce Package) was that, for VAT purposes, electronic interfaces (marketplaces) facilitating certain supplies of goods from an underlying (actual) supplier (i.e., a marketplace) became the deemed supplier for these sales.

The scope was limited to two cases:

- A marketplace (established within or outside the EU) facilitates the distance sale of B2C goods destined for the EU (“import model”) from a third country or territory (not exceeding a value of EUR 150).

- A marketplace facilitates the B2C supply of goods within the EU where the underlying supplier is not established in the EU – regardless of the place of establishment of the electronic interface, or the value of the supply (“intra-EU model”).

The marketplace was free to use IOSS as a settlement model, but this was optional.

This situation now changes with ViDA, as marketplace liability is significantly extended.

Marketplace liability & transparency - linking VAT ID & transport ID

ViDA enhances VAT liability for marketplaces in and to EU; IOSS becomes mandatory

Under the expanded scope of ViDA, the deemed supplier rule (VAT liability) will include all supplies of goods within the Union facilitated by an electronic interface, irrespective of where the underlying supplier is established and irrespective of the status of the purchaser.

In addition, it introduces the deemed supplier model for short-term accommodation rental and passenger transport which will follow the model for ecommerce goods.

Use of the IOSS model (currently optional) will become mandatory for electronic interfaces when they facilitate imports of goods to consumers in the Union.

Taxable persons who operate electronic interfaces and who exclusively facilitate domestic supplies within their Member State of establishment should fall outside the scope of this measure.

Linking transport ID and VAT ID reduces fraud and increases security

ViDA proposes a more secure verification process for VAT IDs (including IOSS), allowing the Commission to adopt an implementing act to introduce special measures to prevent certain forms of taxevasion or avoidance.

Amongst others, these special measures include linking the unique consignment ID (postal items: S10 or S26, or ISO 15459-compliant transport IDs used by commercial carriers) with the VAT identification number. This allows security checks and evaluation to be conducted at consignment level.

We assume that the EU and Member States will also use this transparency of B2C supplies in related areas such as registration and fee obligations for packaging, sustainability (CO2 and GHG allocation), etc.

(This article summarizes the series of 4 CLS LinkedIn posts on the Future of Ecommerce: Upcoming reform of EU VAT legislation (ViDA))

Top image by Pete Linforth from Pixabay

- Home ›

- One Stop Europe ›

- VAT in the Digital Age (ViDA)

Unsure how these changes will impact your business? Contact us for a

free initial consultation.

35+ Years' Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.