- Home ›

- One Stop Europe ›

- Postal Customs Clearance

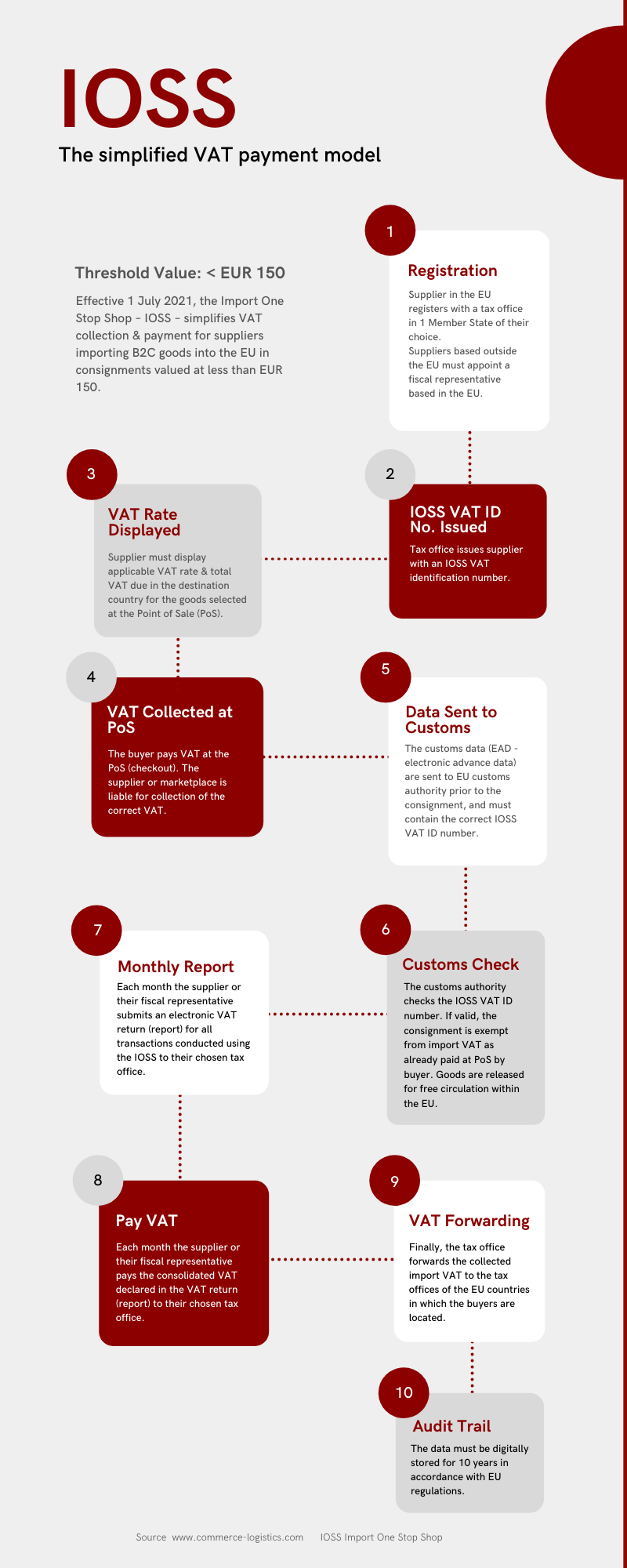

Postal Customs Clearance

The EU VAT Ecommerce Package (1 July 2021) changes how VAT is

paid and settled with the tax authorities, and postal customs clearance

procedures in the EU

At A Glance

- The principle of postal clearance, when it is permitted, and the advantages it offers

- 1 July 2021: Fully digital, simplified customs clearance for postal items below EUR 150

- DDU – Delivery Duty Unpaid; postal customs clearance after 1 July 2021

- DDP – Delivery Duty Paid; postal customs clearance & IOSS

(This article summarizes the series of 4 CLS LinkedIn posts on postal customs clearance in the EU)

Most ecommerce items are still delivered by designated postal operators (DO), the delivery service provider in the country of destination tasked by the Universal Postal Union (UPU) member country with fulfilling the universal postal service obligation as enshrined in the convention and acts of the UPU.

What is the principle of postal clearance and when is it permitted?

In each UPU member country, only the DO is entitled to conduct "postal customs clearance". International treaties ratified by all UPU member countries regulate postal customs clearance procedures worldwide, and these, in turn, are reflected in national customs laws.

According to the UPU convention and treaties:

- Items for postal customs clearance must be sent using the UPU’s IT system and applicable UPU standards (e.g., postal transport ID S10, postal customs forms CN22 or CN23 are mandatory when sending goods/merchandise)

- Electronic Advanced Data (EAD) at postal item level must be sent in advance by the DO in the country of origin to the DO in the country of destination.

- The DO in the country of destination is responsible and obliged to conduct import customs clearance. This is non-negotiable and mandatory worldwide.

- This principle only applies to shipments exchanged across borders between DOs. The DO in the destination country may charge a customs clearance fee which is published and whose application must be non-discriminatory.

The competitive advantages of postal customs clearance

Prior to 1 July 2021, postal customs clearance to the EU was unrivalled in terms of price and simplicity.

DOs were the only operators permitted to clear customs based purely on postal paper forms (physical CN22/CN23 form attached to the shipment). As shipments with a value below EUR 22 were exempt from customs duty and VAT, postal customs clearance for these shipments could be offered practically free of charge.

Consequently, there were effectively two separate ecommerce customs worlds:

- Low-cost, simplified and mostly paper-based postal customs clearance; and

- "Full" digital customs clearance for everyone else.

This all changed dramatically on 1 July 2021.

1 July 2021: Fully digital, simplified customs clearance for postal items below EUR 150

On 1 July 2021, the EU VAT Ecommerce Package came into force, changing the EU customs world dramatically:

- Import duties now apply on all consignments below an intrinsic value of EUR 150 (‘Low Value Consignments’ – LVC), and

- Customs applies for consignments valued above EUR 150.

At the same time, the DOs lost their customs privileges and are now treated the same as express and other stakeholders.

While

nothing has changed for the customs clearance of consignments above EUR 150,

below that value everything has changed: simplified customs clearance based on

electronic advance data (EAD)

was introduced. And VAT can now be paid at the time of purchase in a third,

non-EU country (via the Import One-Stop-Shop).

What happened to the special rights of DOs?

Simplified, digital customs clearance for LVC became mandatory for both DO and all other stakeholders. Paper-based customs clearance in the postal sector is now history – all DOs must submit the EU version of EAD to customs.

Some special rights remain – only DOs are allowed to provide simplified customs clearance for consignments valued between EUR 150 – EUR 1000, and the "prima facie presumption" still applies, with DOs allowed to represent consignees without a power of attorney.

Naturally, DOs may continue to use the global data formats standardized by the UPU & the World Customs Organisation (WCO), but these are fully compatible with the EU customs data model. Special postal transit and transshipment only applies to DOs.

How have DOs responded to this change?

DDU (Delivered Duty Unpaid) has become much more expensive and less competitive.

The classic postal model obliges the DO in the destination country to manage customs clearance. This corresponds to the DDU model where the buyer is responsible for all customs procedures and must pay custom duties, taxes, and other fees. In the postal world, the DO may act as the buyer's agent and does NOT need an individual power of attorney.

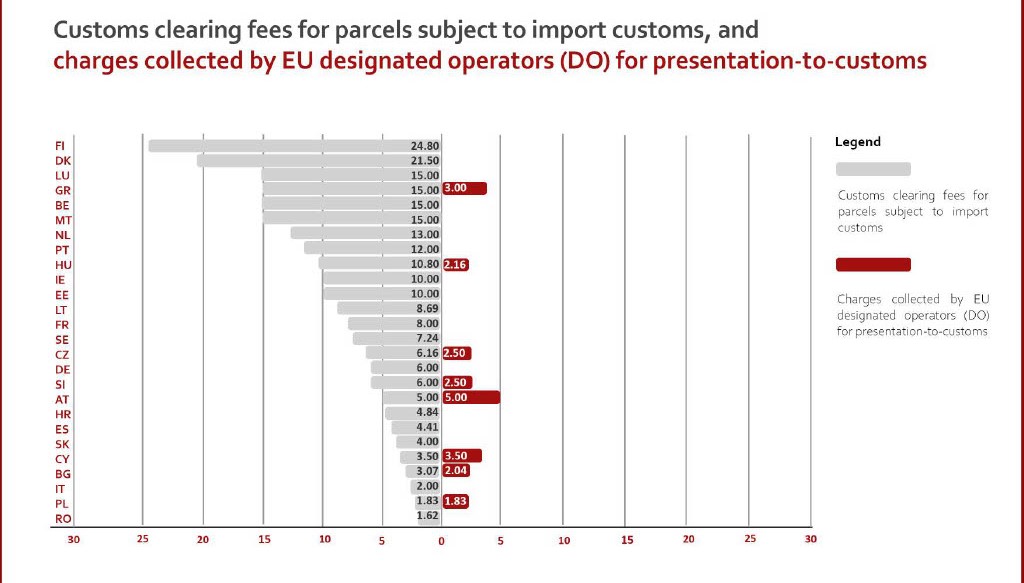

As a rule, the customs fees (VAT in the case of LVCs) are collected from the recipient, and the DO may charge a fee for this service which is charged to the recipient on a non-discriminatory basis.

DDU – Delivery Duty Unpaid; postal customs clearance after 1 July 2021

According to EU regulations, in the case of DDU the customs fees must be paid by the buyer. However, as dealing directly with customs authorities is time consuming and difficult for consumers/buyers, this step is traditionally managed by representatives.

For postal items, the representative is the designated postal operator (DO) at destination, who has the advantage of not requiring a separate power of attorney. The DO is permitted to charge processing fees for customs declarations and for collecting the fees from the buyer.

The processing fees for collecting customs duties are traditionally fairly high. Prior to 1.7.2021, however, this was irrelevant as almost all postal items fell below the previous threshold value of EUR 22: no customs fees were due and, using the previous paper-based model, postal customs clearance was thus offered free of charge.

As of 1.7.2021, however, postal fees are now collected for all DDU items.

As most items are still low-value consignments (<150 EUR), the fees were suddenly very high compared to the purchase price of the goods.

This has angered recipients, many of whom started refusing to accept delivery due to the increase in indirect costs, and subsequently to order less online. DDU volumes in the postal channel have dropped drastically.

How did EU DOs react?

Although this development rendered the UPU postal channel less competitive, EU DOs did not respond by lowering their processing fees or introducing cheaper (digital) payment options. Why?

Probably because, even with overall decreasing volumes, these fees are still highly profitable for the respective DOs.

Most items are still delivered by the EU DOs, but collected directly from foreign online shops and marketplaces at origin, bypassing DOs at origin using the commercial and not the postal channel.

Apart

from recipients faced with a new set of unaccustomed postal fees, the “losers”

here are the non-EU DOs: the major EU DOs use the threat of fees to circumvent

non-EU DOs at origin by channelling non-domestic volumes directly into their

networks and the networks of their commercial subsidiaries (DHL, DPD, GLS...). While

smaller EU DOs without their own international operations have, at least,

earned additional income from processing fees.

DDP - Delivery Duty Paid; postal customs clearance & IOSS

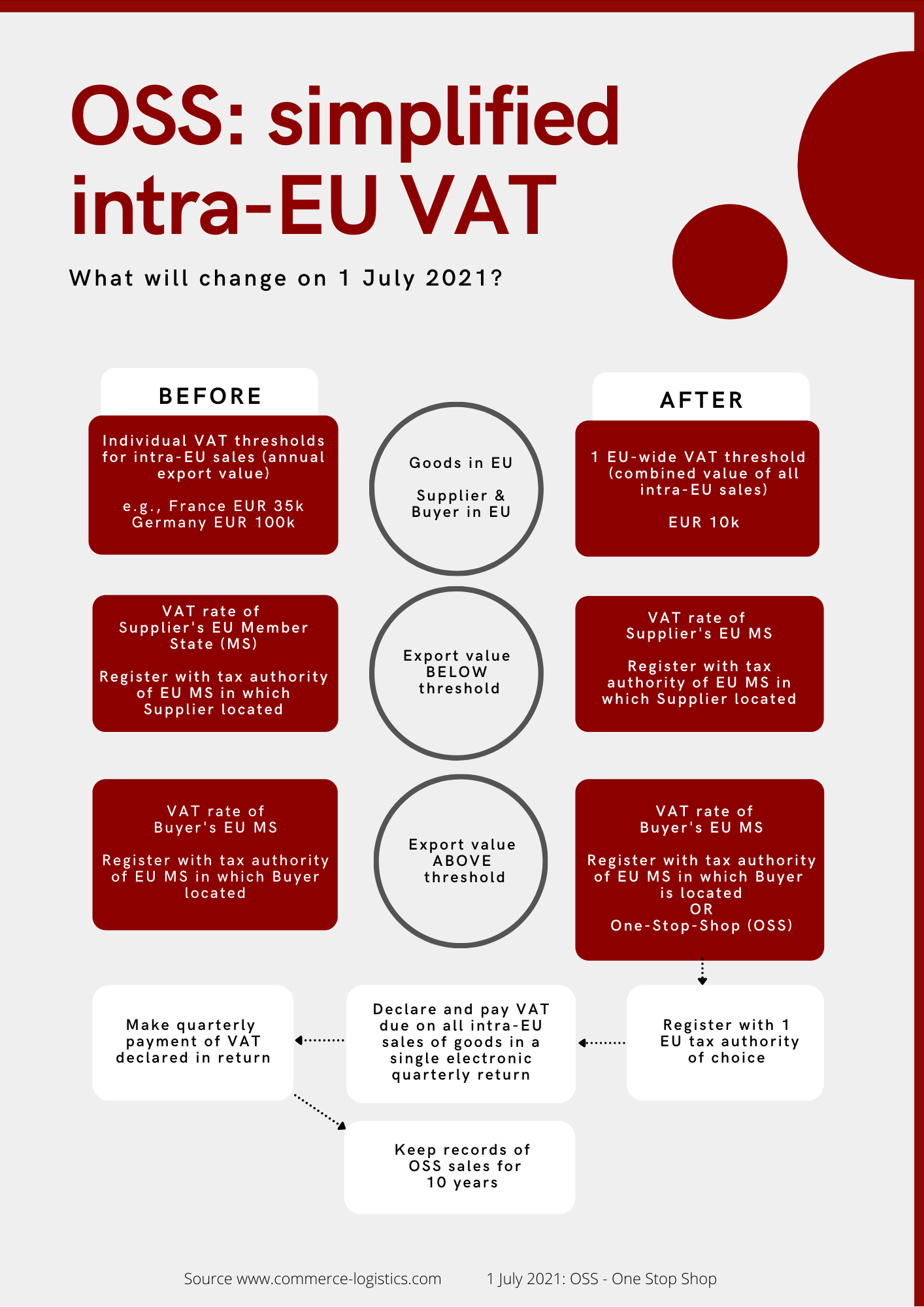

Since 1.7.2021, the Import-One-Stop-Shop (IOSS) has allowed VAT for low-value-consignments (intrinsic value < EUR 150) to be paid at the time of purchase abroad, provided the seller has registered a IOSS VAT ID number (directly, or via fiscal representative) in the EU.

This model supports DDP (Delivered Duty Paid): the seller is responsible for paying import duties, taxes, and fees.

In the postal sector, this model is not relevant for C2C as consumers do not usually have an IOSS registration in the EU. Corporate B2C senders can now use IOSS, including postal delivery.

With IOSS, EU DOs do not have to collect customs duties as the VAT (in the form of import duties) is paid at the time of purchase.

A simplified digital customs declaration must be pre-lodged by the postal operator based on the EAD information sent in advance by the DO in the country of origin.

In the classic postal model, import customs clearance MUST be carried out by the DO in the destination country. In the new EU model, postal and express LVC are treated equally. Customs data for pre-lodging declarations is similar but not identical to the UPU data model (EAD).

Once IOSS is used, a single customs authority may release items for free circulation throughout the EU.

How have posts reacted to the new IOSS business case?

Large and internationally oriented DOs, such as DE, FR, ES, IT, NL, BE and DK/SE, have not charged for simplified digital pre-lodging.

Others, including some Eastern and South-Eastern EU DOs, are charging fees for IOSS consignments. While customs clearance costs in the commercial sector are in the cent range, some DOs are charging up to EUR 5 (Austria) for this service. Postal delivery of IOSS items has become unattractive for recipients, although generating additional revenue for DOs over the short and medium-term.

In summary, the EU VAT Ecommerce Package has essentially ended the postal customs privilege in the EU. Postal operators are currently charging a wide range of different customs fees, some also for IOSS handling, others not.

As a result, volumes in the UPU mail channel have decreased significantly, with some migrating to the direct entry channels of the big EU DOs, and others to commercial carriers such as DHL, DPD, GLS, etc.

- Home ›

- One Stop Europe ›

- Postal Customs Clearance

The Commerce Logistics Specialists provide the advice and support you need to succeed in this evolving digital commerce & logistics environment.

35+ Years' Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.

Contact us to find out more.