- Home ›

- One Stop Europe ›

- International Ecommerce

International Ecommerce

ARE YOU PREPARED? — 8 KEY FACTORS SHAPING ECOMMERCE IN 2021

At A Glance

- 1 January 2021: Electronic Advance Data for pre-declarations

- Real-time digital goods & inventory management

- 15 March 2021: Digital entry & exit air freight transport declarations

- 1 April 2021: IOSS VAT ID

- 1 July 2021: EU VAT Package

- IOSS: Improved returns management

- Separate delivery & payment flows

- EU plans further digitalization steps to 2025

International ecommerce is growing at an explosive rate, and not simply in response to the coronavirus pandemic. This growth creates huge opportunities, but only for those merchants & marketplaces ready to comply with the new framework conditions effective from 2021.

These include mandatory digital pre-declaration of each individual commercial item prior to entry into the EU, and the intra-EU One Stop Shop (OSS) system providing fiscal representation in one EU Member State for the entire EU.

Any online retailer intending to engage in international ecommerce in 2021 must be ready to adapt to these 8 changes:

1. 1 January 2021: All cross-border commercial items sent through postal channels must be digitally pre-declared

From 1 January 2021, postal operators around the world will be demanding digital pre-declarations for every single international ecommerce delivery consignment, of any value.

This Electronic Advance Data (EAD) must include the name and address of the sender,

recipient, their telephone number or email address, the number of items in the consignment,

the total weight, the type of transaction (traded good, gift, etc.), postal

fees, plus a description, number, individual weight, value, country of origin

and harmonized customs number (minimum 6-digits) for every single item in the

consignment.

2. Real-time digital goods and inventory management

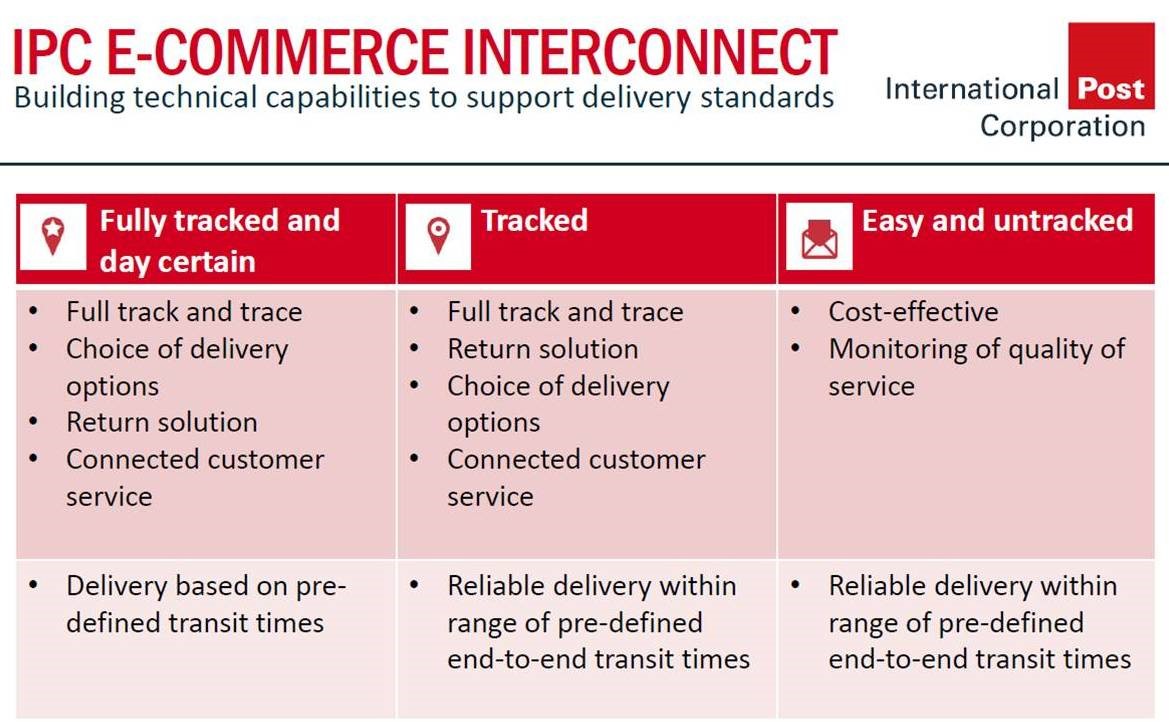

International ecommerce will increasingly depend on real-time digital inventory management, allowing goods to be offered and sold on multiple platforms, marketplaces, and websites.

Digital inventory management follows EU specifications, in particular the digital specifications in the EU Customs Data model, as well as increasingly also the upcoming EU Transport Data Model.

3. 15 March 2021: Exit and entry summary declarations for air freight transport

The EU’s new Import-Control-System 2 (ICS2) comes into effect on 15 March 2021.

This requires courier, express and parcel services to submit digital pre-declarations for all commercial items entering or exiting the EU as air freight transport.

The EU’s harmonized ICS2 will enhance transport security for

consignments using air freight, by harmonizing global and European air freight-related

pre-loading information and related communication between authorities and

transport and logistic operators.

4. 1 April 2021: Issue of Import-One-Stop-Shop (IOSS) VAT ID for international ecommerce begins

From 1 April 2021, all online retailers importing goods from third countries into the EU will be able to apply for an Import-One-Stop-Shop VAT ID number in one EU member state.

Retailers with an IOSS number will not be subject to import tax on low value consignments anywhere in the EU; the VAT due in the EU member state (including Norway) in which the goods are consumed must be transferred by the IOSS representative on the 16th of the following month to the financial authorities of the EU member state in which the IOSS is registered.

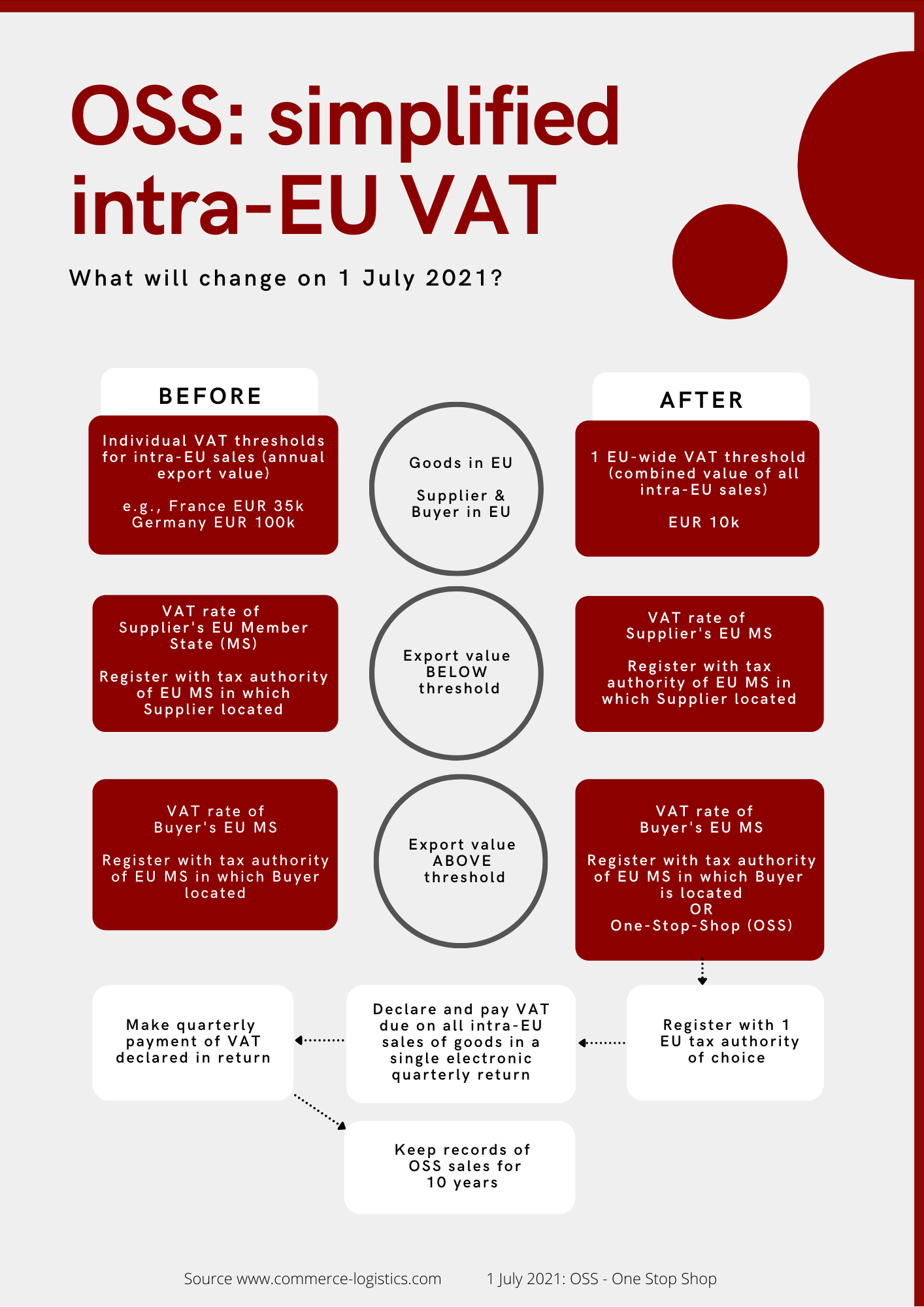

5. 1 July 2021: Implementation of the EU VAT Package

As of 1 July 2021, new EU rules apply within the EU and for the import of commercial items into the EU, as well as for intra-EU distance sales.

The import VAT exemption on goods valued at €22 or less (de minimis rule) is being withdrawn. All commercial items will be subject to VAT. The VAT is calculated according to the VAT rate in the member state of consumption. All commercial items sent to the EU by a seller in an EU third country, or their agents, must be digitally pre-registered with the EU customs authorities. A reduced dataset may be used for low value consignments (value of the goods in the consignment < €150).

Where the seller includes an IOSS VAT ID number in the digital pre-declaration (only valid for low value consignments), then the low value consignment is not subject to import VAT. The VAT due in the member state of consumption will be collected by the fiscal representative in the EU member state in which the seller is registered for the IOSS.

Where the seller has no IOSS VAT ID number, a second method is available for simplifying imports: the agent registering the import (e.g., post, courier, express, parcel operator or customs agent) will collect the import tax from the end customer and submit this to the customs authorities monthly.

6. Returns management: International ecommerce benefits from improvements to One-Stop-Shop returns handling

The OSS system used in international ecommerce will make it easier to digitally manage and bill the frequent returns associated with ecommerce, by enabling the relevant reports to be delayed.

This removes the need for the protracted processes involved today, while increasing transparency and reducing costs. In addition, all the parameters relating to any partial returns are already covered in the mandatory digital pre-declaration.

7. Separate delivery and payment flows

The separation of commercial item delivery and the payment of duties, etc., begins during preparation of the consignment for the digital pre-declaration (registration with customs authorities, ICS2 summary declaration, VAT report).

Consequently, as no more low value VAT relief will be available, and as online marketplaces become VAT collectors, payment, logistics and final delivery may all be conducted by different operators in accordance with newly developed business models.

8. EU will take further digitalization steps in its plan to 2025

Today IOSS is optional but – as already proposed by the European Commission – may become mandatory for commercial items sent by an EU third country seller or their agent by 2025.

Furthermore, the EU intends to enhance the number of datasets incorporated in the electronic advance data (EAD) to include information related to the safety and correct handling of the content in any commercial consignment, the nature of the packaging, and the individual delivery preferences of the final addressee, in order to enable contactless delivery.

Leverage international ecommerce opportunities with CLS

All in all, these new regulatory steps will foster the interoperability of parcel delivery operations, helping promote international ecommerce by creating a Digital Single Market for the European Union.

The journey starts in 2021. It will further digitalize international ecommerce, support the Green Deal by making delivery processes more effective, efficient, and CO2 neutral, enhance transparency and visibility, and adapt analogue infrastructures so that they can become digitally embedded.

The Commerce Logistics Specialists provide the advice and support you need to succeed in this evolving digital commerce & logistics environment.

35+ Year's Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.

Contact us to find out more.

- Home ›

- One Stop Europe ›

- International Ecommerce