- Home ›

- One Stop Europe ›

- OSS – One Stop Shop

One Stop Shop

How The One Stop Shop (OSS) simplifies intra-EU VAT payment for B2C ecommerce

16 June, 2021

Author: Martin Füll Linkedin

Share this article:

The Ecommerce Big Bang Series

Just as the ‘Big Bang’ of 1986 revolutionized the financial markets, the EU eCommerce VAT Package which comes into effect on 1 July 2021 will redefine global online retail. Our Ecommerce Big Bang series is your guide to the future of European ecommerce:

- Before and after – the key changes to B2C e-commerce

- Importing goods into the EU: the Import One Stop

Shop (IOSS)

- Cross-border distance selling in the EU: the One Stop Shop (OSS)

- Why OSS may only be a transitional solution for cross border trade

- Will new postal fees for IOSS effectively end the UPU universal service in the EU?

The OSS and the intra-EU declaration of VAT

On 1 July 2021, the EU VAT e-commerce package comes into force.

In this, the third in our Ecommerce Big Bang series, we outline the impact of the new regulation on managing VAT when selling and shipping goods across EU internal borders, and explain the new, simplified VAT payment option – the One Stop Shop (OSS).

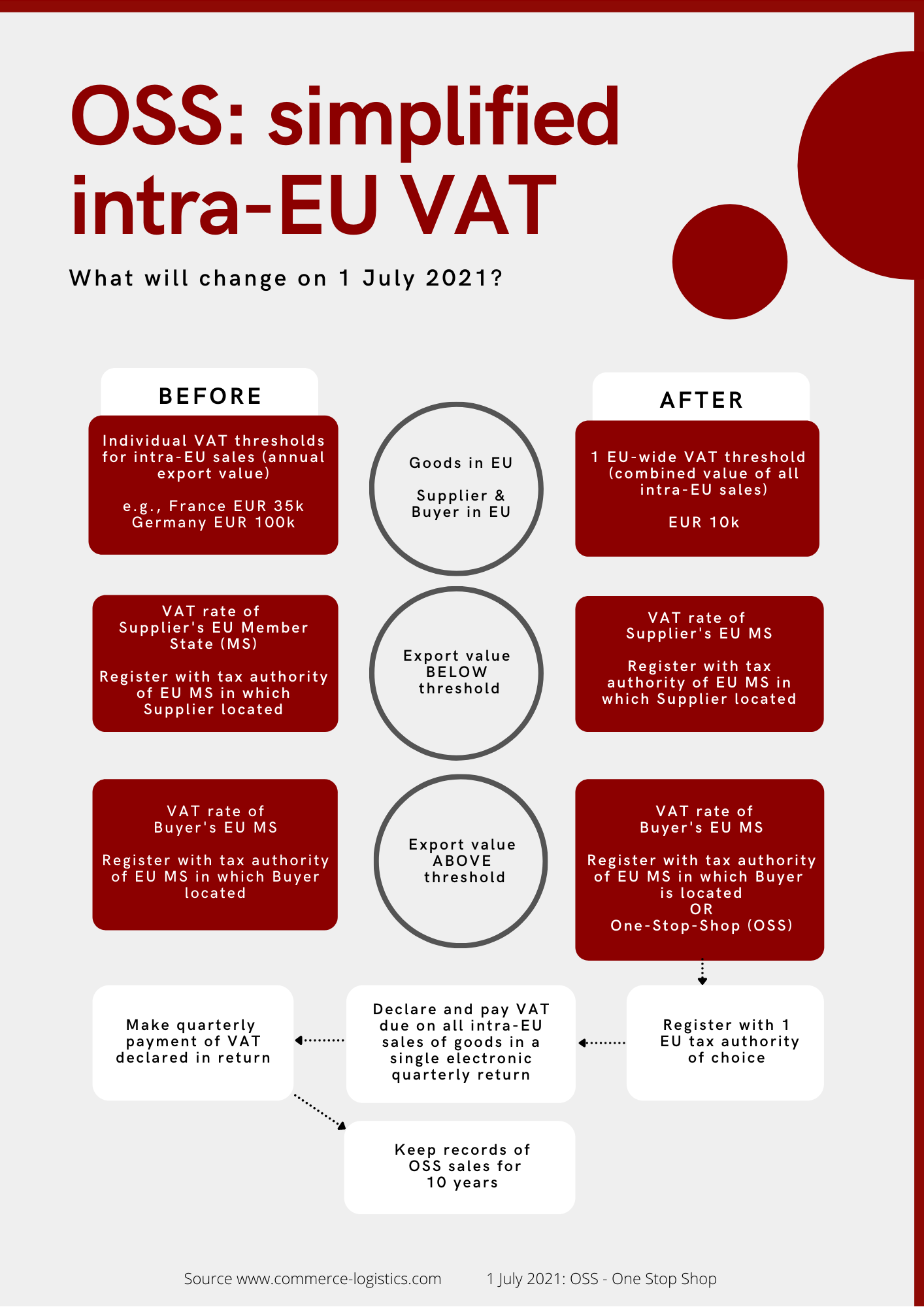

Intra-EU distance selling – the current status

The current principles for paying VAT on distance sales (sales contract concluded exclusively online) are fairly simple:

- Domestic: When a Supplier sells to a Buyer in the same country, they use their local VAT number and apply the domestic VAT rate.

- Cross-border: When a Supplier sells to a Buyer located in another EU country, the ‘Member State of Consumption’ (MoC) principle is applied: VAT is a tax on the end consumer, so the Buyer must pay the VAT rate of the country in which they are located. The Supplier must register with the tax authority in the Buyer’s country, and pay the collected VAT to that foreign tax authority.

As it is time-consuming and costly for a Supplier to register in multiple EU Member States, the EU created a simplified regulation for small shippers:

- Cross-border below annual country threshold: When a Supplier sells to a Buyer located in another EU Member State, and the combined value of their sales to this country remains below the annual threshold for that country, the Supplier may use the VAT ID/registration and VAT rate applicable in their home country. If the annual sales value exceeds this country threshold, then the regular cross-border rules (VAT rates of and registration in destination country) apply.

Prior to 1 July 2021, each EU Member State has been free to set its own distance selling registration threshold – these currently range between EUR 25,000 and EUR 100,000.

Each threshold is country-specific: where the export value to one country exceeds its threshold, the VAT rates of this destination country apply; where the export value to another country stays below that country’s threshold, the home VAT rate may be applied to exports to this country.

Example: The current thresholds for distance selling to Austria and France are EUR 35,000, to the Netherlands EUR 100,000.

If a German Supplier sells goods worth EUR 30,000 to France, EUR 40,000 to the Netherlands and EUR 50,000 to Austria in any one year, it remains below the threshold in France and the Netherlands. Here it can offset German VAT (19%) and pay it to the German tax office.

In Austria, it has exceeded the country threshold of EUR 35,000, and so the Buyer must pay the Austrian VAT (20%).

Details of the current thresholds are available here.

What changes on 1 July 2021?

- New VAT threshold: A single, EUR 10,000 threshold will be introduced for all intra-EU exports (combined) to other EU Member States.

- Marketplaces become liable: The Marketplace ('electronic interface') becomes liable for collecting VAT on all

transactions processed through its platform. This also applies where the sales contract

is concluded with an independent online trader who only uses the Marketplace as

a sales channel. (More details below.)

- One-Stop-Shop (OSS): The OSS simplifies the process of paying VAT on distances sales to consumers within the EU.

The new, lower VAT threshold

The EU VAT e-commerce package creates a new and lower VAT threshold: from 1 July 2021, the use of home VAT rates for distance sales to other countries is only permitted where the combined annual value of sales to all EU destination countries is below EUR 10,000.

Where sales exceed EUR 10,000 in any one year, then the Supplier must apply the VAT rates of the destination country, and register with the tax authorities in all destination countries.

Example: A German Supplier ships a total of EUR 30,000 + EUR 40,000 + EUR 50,000 = EUR 120,000 worth of goods to other EU countries.

This is well above the limit of EUR 10,000 for the entire EU.

The Supplier must now declare and charge French VAT rates (20%) for all sales to France, Austrian VAT rates for all sales to Austria (20%), and Dutch VAT rates (19%) for all sales to the Netherlands, as well as registering and pay VAT to the respective tax offices in all three EU destination countries.

The goal of the One Stop Shop (OSS) – simplification

In order to simplify and promote intra-EU trade, as of 1 July 2021, Suppliers shipping their goods from a single country who exceed the intra-EU threshold are no longer forced to register for foreign VAT in multiple destination countries.

The One Stop Shop allows Suppliers to:

- Register for VAT electronically in a single EU-Member State for all intra-EU distance sales of B2C goods and services; the VAT rates of the the Buyer's destination country must be applied.

- Declare and pay VAT on all goods and services in a single electronic quarterly return.

EU Suppliers wishing to use the One Stop Shop must register in the EU Member State in which their business is established.

They may use their existing VAT ID to submit their OSS returns. If chosen, the One Stop Shop must be used for ALL intra-EU sales.

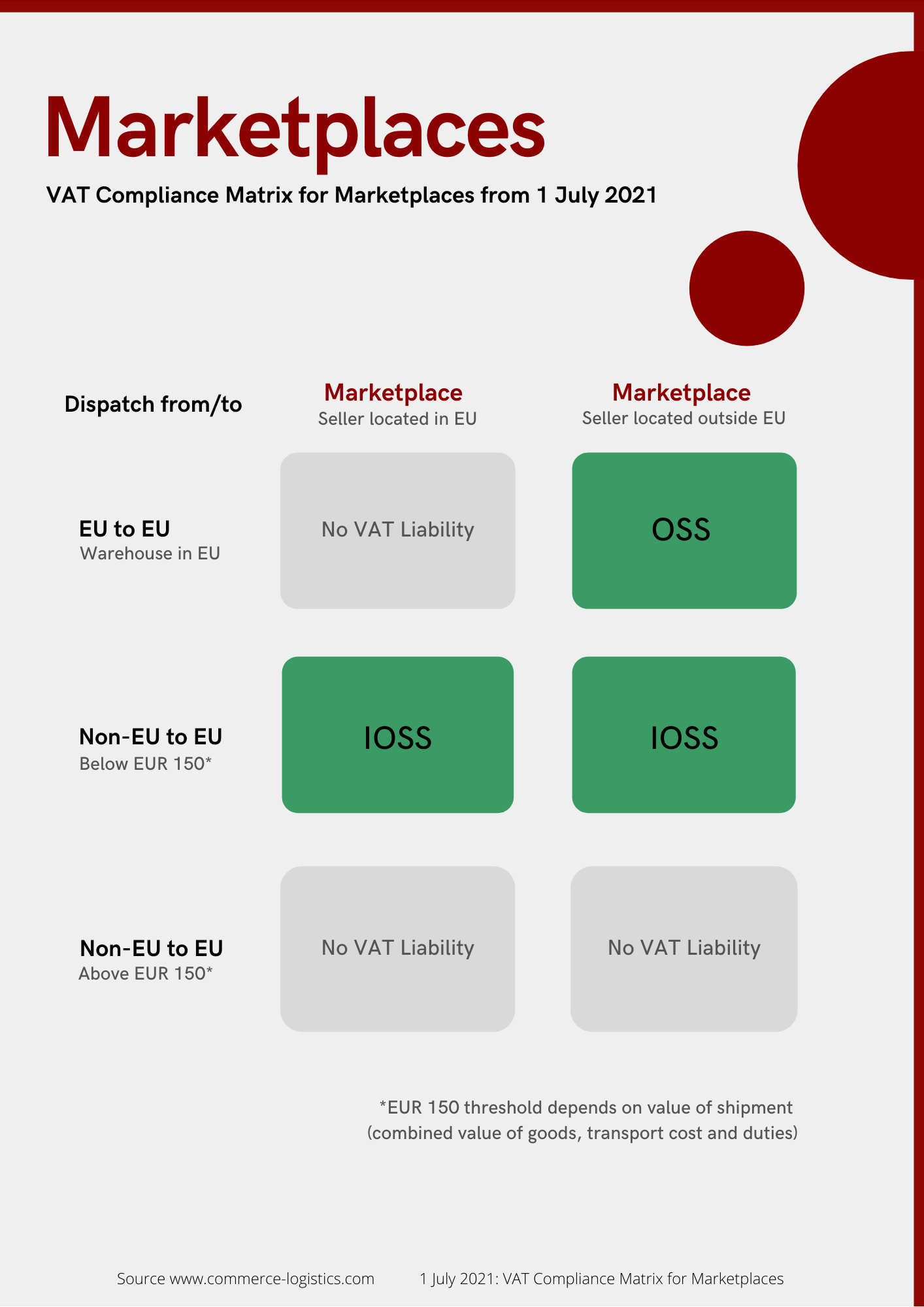

New: Marketplace liabilty for intra-EU sales

From 1 July 2021, where the conditions below are met, the Marketplace will be liable for VAT for sales of goods via an electronic interface (Marketplace). Here it is the Marketplace – not the Seller – who must collect the VAT from the final client and transfer it to the relevant tax authority.

The Marketplace is liable where:

- Goods are dispatched from outside the

EU and imported to the

EU (in this case, the Marketplace is liable for

all sales from Sellers located in or outside the

EU up to a value of 150 EUR per shipment); and

- Goods are dispatched within the EU and the Seller is located outside the EU, irrespective of the value of the shipment.

In principle, the One Stop Shop is designed for Suppliers located in the EU and trading within the EU. Suppliers importing goods from outside the EU can use the Import One Stop Shop – IOSS.

But as Marketplaces are also liable for Non-EU sellers whose goods are dispatched from within the EU (e.g., from a warehouse established in an EU Member State), Marketplaces are an exception to this principle. In this case, as Marketplaces are liable for the collection and payment of intra-EU VAT, they may register to use the One Stop Shop to transfer VAT on sales from Non-EU sellers to one selected tax authority.

The Marketplace must use a tax intermediary (fiscal representative) based in the EU, and will be issued with an individual VAT ID by the Member State of Identification.

A Marketplace based outside the EU which initiates intra-EU dispatches needs to register for the One Stop Shop in the/one of the EU countries from which they send goods to Buyers – this country is called the Member State of Identification (MoI).

Who can use the One Stop Shop?

A taxable person (Supplier) established in the EU can use OSS for:

- Intra-EU sales of goods (to all Member States except the Member State in which the Supplier is based);

- Domestic sales of goods where the goods are dispatched

from a warehouse located in another EU Member State; and

- Supplying B2C services performed in another Member State.

A marketplace (electronic interface), either inside or outside the EU, which facilitates supplies of goods (a so-called 'deemed supplier') may use OSS for:

- Distance sales of goods within the EU, and

- Domestic supplies of goods.

The advantages of the One Stop Shop

- VAT registration is only required in ONE Member State;

- Suppliers with existing VAT registrations in multiple Member States can close them and opt to use the OSS scheme;

- Quarterly

payment and reporting; and

- Suppliers can work with the tax administration of their own Member State and in their own language.

The One Stop Shop workflow in 6 easy steps

- Register: Each EU Member State provides an online OSS portal. Businesses can register with the portal from 1 April 2021 onwards, and use for transactions conducted from 1 July 2021. Where the Supplier is a Non-EU Electronic Interface (marketplace), a tax ID will be issued;

- Display correct VAT rate: Suppliers and Electronic Interfaces must apply the VAT rate of the Member State in which the Buyer is located or the services are performed. The VAT rate of this destination country must be displayed to the Buyer at the point of sale (checkout) at the latest;

- Collect VAT: The Supplier collects the VAT from the Buyer;

- Submit an electronic quarterly VAT return: The Supplier submits the quarterly VAT return via the OSS portal; this return is in addition to a domestic VAT return; distance sales must be broken down by Member State and the applicable tax rates stated;

- Quarterly VAT payment: The Supplier pays the VAT declared in the VAT return to the Member State on a quarterly basis;

- Audit trail: The Supplier is required to keep records of all eligible OSS sales for a period of 10 years.

Alternatives to the One Stop Shop?

The One Stop Shop is optional.

It will be still possible for Suppliers or Marketplaces to use the current scheme – apply the domestic VAT rate up to an export value of EUR 10,000, and register in all destination countries when exceeding this threshold – but this model will be more expensive and complex.

Author: Martin Füll Linkedin

Share this article:

Unsure how these changes will impact your business? Contact us for a

free initial consultation. For more information see the CLS Blog and the EC’s Tax and Customs Union

website.

The CLS Commerce Logistics Specialists are actively shaping the new, legal environment for digital commerce at the Universal Postal Union (UPU), as experts on EU Commission Working Groups (DG TAXUD, DG MOVE), and through Ecommerce Europe (the umbrella association of Europe’s national ecommerce associations), and European Standardization (CEN). CLS is supporting and advising a variety of stakeholders in the industry – postal operators, logistics service providers, online shops and marketplaces.

- Home ›

- One Stop Europe ›

- OSS – One Stop Shop

The Commerce Logistics Specialists provide the advice and support you need to succeed in this evolving digital commerce & logistics environment.

35+ Years' Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.

Contact us to find out more.